Newsletter: "Collectable" Network

This week we cover Zora Network launch, Blockchain <> AI (LLMs), IMF on Crypto & CBDCs, TradFi "Takeover", Mirror Collective Embeds & Spotlight, plus Market Trends (Crypto Corporate Report), mainstream news and Signal TL;DR.

By Forefront - Jun 26, 2023

Good morning and welcome to edition 146th of the FF Newsletter.

This week we cover Zora Network launch, Blockchain <> AI (LLMs), IMF on Crypto & CBDCs, TradFi "Takeover", Mirror Collective Embeds & Spotlight, plus Market Trends (Crypto Corporate Report), mainstream news and Signal TL;DR.

Let's get to it.

👋 Looking for a way to support Forefront? We’re opening up the FF Newsletter to sponsors interested in sharing their company, project, or community with +10,000 of web3’s most curious minds. If you are interested in becoming a sponsor, check out our Sponsorship Page or DM us on Twitter.

Week’s Highlight

The age of L2s for onchain media is upon us.

Zora Network is live, and Zora is now multichain. NFTs across all networks look the same, with no different subdomains required. Dozens of companies and protocols are already supporting the new network, including Forefront, which now fully supports Zora Network on Spotlight for our onchain media curation.

Ryan Yi notes that app chains are not new. The difference in 2023 is that they are coming to EVM, where the majority of users + integrations (wallet, validator, bridge, node) support. Optimism's OP Stack is open-source and allows any project/team to launch their own roll-up chain. Zora and Coinbase (via Base) are both building on this stack.

The long-term payoff will come down to the project's ability to lean on their user network effects. It's not purely a tech game, it's a BD/Strategy game. 2023 app chains are about value capture as much as it is about tech. We discussed last week how Zora's venture into L2s + their existing brand positioning could make Zora Network the go-to chain for media NFTs, even "luxury" ones that usually exist on mainnet, regardless of technical specs.

Take Note. L2 activity is ramping up. Sound.xyz and other media protocols and products are leaning into the narrative as well, and it's only a matter of time before collector and creator volume explodes in an incredible way.

What's Poppin'

Spotlight Capsule 003 Drop In Collaboration With Mirror Via Collectible Embeds. This week, Mirror launched Collectible Embeds: a way for users to embed NFTs from across Ethereum into your Mirror posts, and let readers collect inline. Spotlight curates ideas and experiments worth collecting, powered by Forefront. Alongside our third Capsule drop, Forefront partnered with Mirror to leverage Collectible Embeds, making it possible to collect tokens from a capsule both on Spotlight and in your inbox. If you want to be notified on every new Capsule drop, subscribe to the Spotlight Mirror publication and be sure to collect works that resonate!

Bitcoin Skyrockets to 1-Year High as BlackRock ETF Buzz Ignites Frenzy. Bitcoin hit a more than one-year high on Friday, capping a week of gains helped in part by BlackRock's plans to create a Bitcoin ETF despite heightened U.S. regulatory scrutiny on the digital asset sector. BlackRock, the world's biggest asset manager, filed last week to launch iShares Bitcoin Trust, an ETF that would have Coinbase Custody as its custodian as well as offer institutional investors exposure to the cyptocurrency. Much of the market has followed suit, with some assets slower to respond due to regulatory scrutiny.

Shifting Tides: CBDCs Gain Momentum in Latin America and the Caribbean, Reshaping Global Crypto Landscape. Latin America and the Caribbean (LAC) are leading in digital money adoption, offering valuable lessons for the world. LAC countries have made strides in introducing central bank digital currencies (CBDCs) to enhance financial inclusion and reduce cross-border remittance costs. Some Latin American countries rank among the top 20 in global crypto asset adoption, seeking benefits like protection against uncertainty and improved financial inclusion. Regulatory frameworks for crypto assets vary across the region, with El Salvador granting legal tender status to Bitcoin. Most central banks in LAC are considering the introduction of CBDCs to strengthen payment systems and increase financial inclusion.

Seamless Integration: Harnessing Blockchain for Enhanced Interactivity in LLMs. This piece on blockchains in the age of LLMs explores how AI will be used in crypto environments. The authors argue that LLMs will make blockchains more fun by discovering and describing our intents for us. Through being smart about intents, more P2P transactions will happen and global barter trading will make us all better off. In doing so, LLMs could take a big part of the UX problem off our hands. This would mean that much (most?) of blockchain traffic will be driven by LLMs, especially consumer LLMs that use blockchains as financial rails. The chains and protocols that get the attention of AIs will win. This is a thought-provoking piece that dives into many different intersections of crypto x AI and their potential to disrupt the internet and society at-large.

MTV, Napster and Embracing Destruction. Discussions on LLMs, crypto, and generative AI are expanding our ability to create and consume content beyond existing constraints. However, Jarrod Dicker notes that there is a focus on maintaining current structures instead of accelerating disruption and exploring new possibilities. JD cites Napster, where consumers took control and changed their relationship with music in the internet age. The disruption should have led to the dominance of iTunes, but instead, streaming became the preferred model. Calamitous disruptions actually enable new consumer use cases and business models, shifting value accrual and purpose. The internet consistently democratizes creation and distribution, and emerging technologies like crypto and AI will reshape our means of creation and consumption, expanding passions and businesses. It's crucial to understand consumer behaviors and desires with new technology instead of trying to maintain the current structure.

COLORS Collect: Digital Collectable Platform. COLORS is a studio that highlights artists from across the globe in a short, unique format. Their videos have become staples of the music industry on the internet over the last few years. This week, COLORS announced a partnership with Zora, making it possible to acquire and curate your own unique musical collection. This platform doesn't just let you enjoy the music; it opens up exclusive opportunities and supports artists in the process. This is a really exciting partnership that can open up onchain media and collectibles to a massive audience of music lovers.

Latest on Mainstream...

First, the SEC has approved its first leveraged Bitcoin Futures ETF. Moreover, the Volatility Shares' offering is now the first ETF of its kind to be available in the United States, and it is set to begin trading on Tuesday, according to a Coindesk report.

Next, EDX Markets (EDX), which is backed by Fidelity Digital Assets, Charles Schwab and Citadel Securities, has launched in the U.S. after building out its technology for the past nine months, the company announced Tuesday. With other crypto exchanges under regulatory scrutiny, it remains to be seen how this one will hold up. Banking giant Deutsche Bank AG has also applied for regulatory permission to operate as a crypto custodian in Germany.

Finally, Hong Kong's largest bank HSBC now allows customers to trade bitcoin and ether ETFs listed on Hong Kong's stock exchange.

Signal TL;DR

Testing the Future: SAP Explores Digital Money for Effortless Cross-Border Payments

SAP.com announces that they are testing a solution to make cross-border payments easier with digital money. The article highlights their efforts in experimenting with this technology and emphasizes the potential benefits of digital currencies for streamlined global transactions. The focus is on the ongoing testing phase and the exploration of this solution for future implementation.

Scaling Crypto Apps Not Infrastructure

This piece by Breck discusses challenges in scaling infrastructure for crypto apps due to limited auto scaling capabilities. It explores horizontal and vertical scaling approaches, noting that horizontal scaling attempts in the crypto space have been ineffective. Some apps have pursued vertical scaling by offloading custom logic offchain, sacrificing decentralization. The article encourages crypto apps to explore custom vertical scaling solutions and prioritize user experience over scalability trade-offs.

▹ Read - Bluesky on Moderation

▹ NFT - NFL Rivals Game

▹ Cool - FTX Smart Claim

▹ Interesting - Nouns Nymz

▹ Watch - Jacob Horne via Bankless

▹ Mainstream - FIFA Metaverse Trademarks

▹ Techy - Let's Get HAI

▹ Tooling - (Re)Introducing Party

◎ Check out Signal for daily top web3 social headlines

Market Trends

The State of Crypto: Corporate Adoption Edition

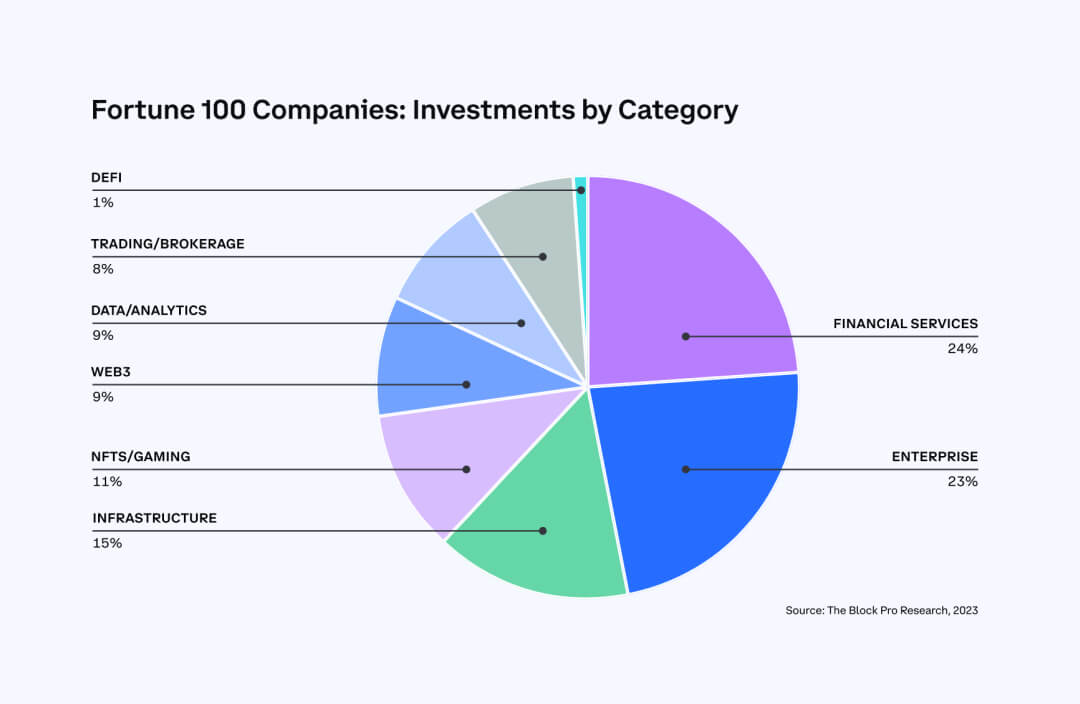

As per a new report conducted by Coinbase, more than 50% of Fortune 100 companies have had crypto projects in the works at varying stages of development since the beginning of 2020. Currently about 60% of Fortune 100 projects have been underway since the start of 2022.

Titled "The State of Crypto: Corporate Adoption," the report revealed 52% of Fortune 100 companies are investing in crypto or blockchain initiatives since the start of 2020. As of Q2 2023, 70% of Fortune 100 companies with crypto initiatives were in the publicly launched stage, the highest level since Q1 2020.

The report indicated that while NFTs may not be the primary focus of many Fortune 100 companies' projects and plans, they are driving a surge in the retail sector's web3 initiatives. This move diversifies participation beyond just tech and financial services and provides companies with a pathway to return on investment.

For the Culture

👋 Looking for a way to support Forefront? We’re opening up the FF Newsletter to sponsors interested in sharing their company, project, or community with +10,000 of web3’s most curious minds. If you are interested in becoming a sponsor, check out our Sponsorship Page or DM us on Twitter.

The information in this newsletter is not intended to constitute legal, financial or investment advice and should not be construed or relied upon as such. Any opinions reflected are the opinion of the author(s) of the newsletter only and not necessarily of Forefront. Please DYOR.