Are L2/Sidechains Ready to Take on Social Tokens?

This is a guest post featuring FF Contributor Makoto Inoue, dev at ENS Domains and co-founder of Kickback in a FF exclusive.

By Makoto Inoue - May 3, 2021

People at the forefront of the crypto scene are paying attention to social tokens and creator economies, probably the next frontier which comes after Defi and NFTs.

One reason is because these communities are scaling quickly. For example, $WHALE, one of the biggest social token on Roll, currently has over $130 million market cap. Before the recent Roll hack incident it had over $250 million.

Coingecko - source

$FWB (Friends With Benefits) was the second biggest social token until Roll was hacked. They issued a new "Friends With Benefits Pro" token on L1 (Layer 1 usually means Ethereum mainnet itself) in order to add more security and prevent future attacks. It probably makes sense to remain in L1 to have the highest security, but what about other smaller cap tokens or new social tokens to follow?

In this blog post, I will list 6 steps you need to take when issuing a social token, then evaluate the use of L2/sidechain in each. For those new to the token space, Layer 2 and sidechains are both ways to refer to Ethereum's scaling solution, which promises lower gas fees in exchange for some potential security and usability tradeoffs. I score each step between 1-5, where 3 is as good as L1.

- Minting new tokens (2/5) - You are a pioneer issuing social tokens on L2/sidechains

- Airdrop (5/5) - You will benefit the most using L2/sidechains

- On-boarding (2/5) - Still cranky but getting better

- Community Engagement (4/5) - Enjoy more interaction without worrying about gas

- Buy NFTs with your Social Token (2/5) - OpenSea on Matic is big news

- Cashing Out (2/5)

Minting new tokens (2/5) - You are a pioneer issuing social tokens on L2/sidechains

When it comes to issuing your own social token on L2, it will be a lot harder than just using big platforms like Roll or Rally as not many people have done that yet. Having said that you can issue tokens using generic DAO management like 1Hive/Colony.io, or Coinvise, which operates on both L1 and Matic.

- Coinvise (Matic)

- 1Hive (xDAI) = Aragon clone

- Colony.io (xDAI)

If you are more curious, this could be the perfect chance to try to create your social token on your own (whether you are a coder or not).

When I got into Ethereum back in 2016, "Create your own ERC20" was the Solidity programming 101. The sort of casual use of smart contracts has been long gone in Ethereum but it may be feasible in the L2/sidechain world. If you want to go down to that rabbit-hole, look no further than following these tutorials from Austin Thomas Griffith.

Because the gas cost is so cheap, you don't have to build lots of solutions which Roll/Rally have built to avoid paying high gas costs, so the solution could be relatively simple.

Airdrop (5/5) - You will benefit the most using L2/sidechains

When you launch your social token, the first way to bootstrap the network effect is to airdrop the token to your existing social network based on certain activities (sharing on social media, contributing to discussions, etc). This was costly to operate against 100s of users even before the high gas and ETH price hit Ethereum and that's why Roll has an "off-chain component" (which is basically a normal database) to store user data. Rally also uses its own sidechain.

Both platforms offer limited data through their API and neither exposes the token balances of each user. This is fairly limiting if you want to give some benefits to your token holders.

In fact, I did miss out on StakeDAO airdrop despite owning a small amount of $JULIEN.

This is where L2/Sidechain shines with super low gas cost. Airdropping tokens to 1000s of users would usually cost $5k~10k worth of gas on L1, but it will be feasible in L2/sidechains.

On-boarding (2/5) - Still cranky but getting better

Once you give tokens to your users, they have to be able to see that they own your tokens.

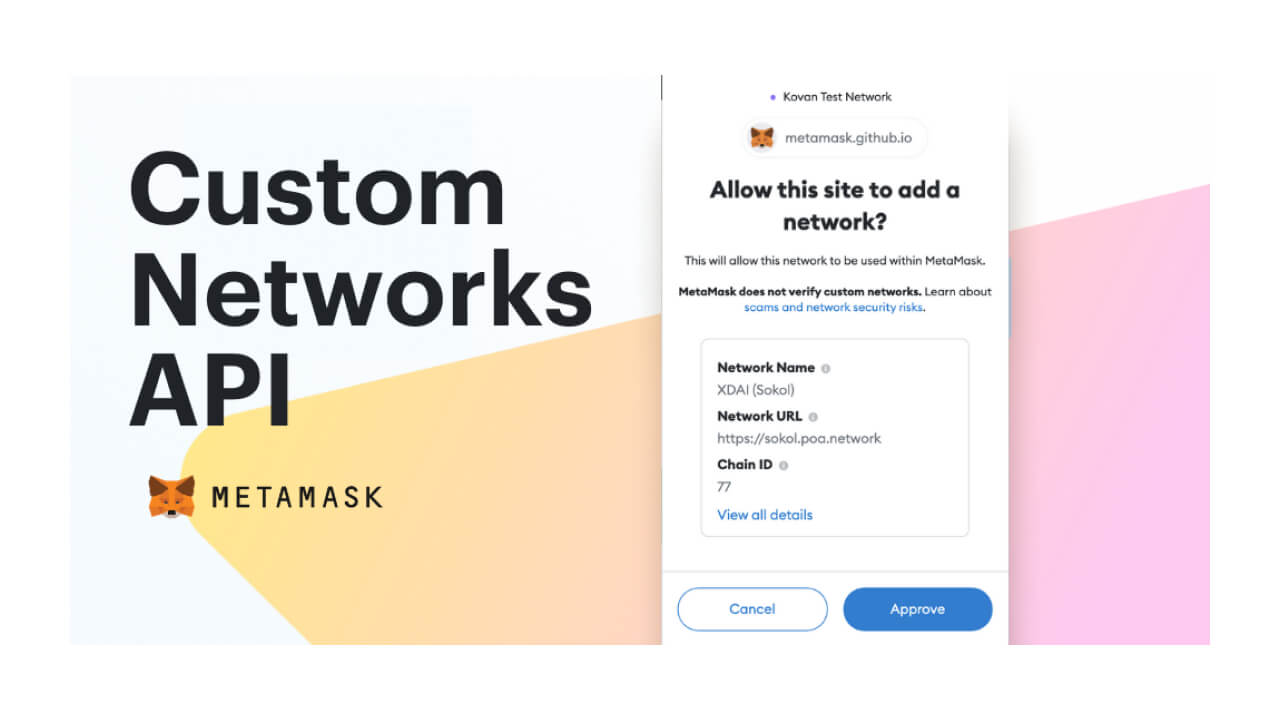

Metamask by default only supports L1 and testnets so to use it with L2/sidechains you have to teach users how to add a new network. This is one of the most cumbersome experiences, but that is changing quickly.

Metamask also recently announced a new API called "Custom networks API" which allows the developer to recommend a specific Layer2 and add all the network info with one click. This is great as users read through manual or documentation to learn how to manually configure Metamask.

Once people cross their asset from L1 to any of L2 or sidechains (which costs lots of gas), crossing tokens across these chains is now possible using Connext network. HoneySwap team (Uniswap clone on xDAI) recently implemented xDAI-Matic bridge which costs only small amount of gas.

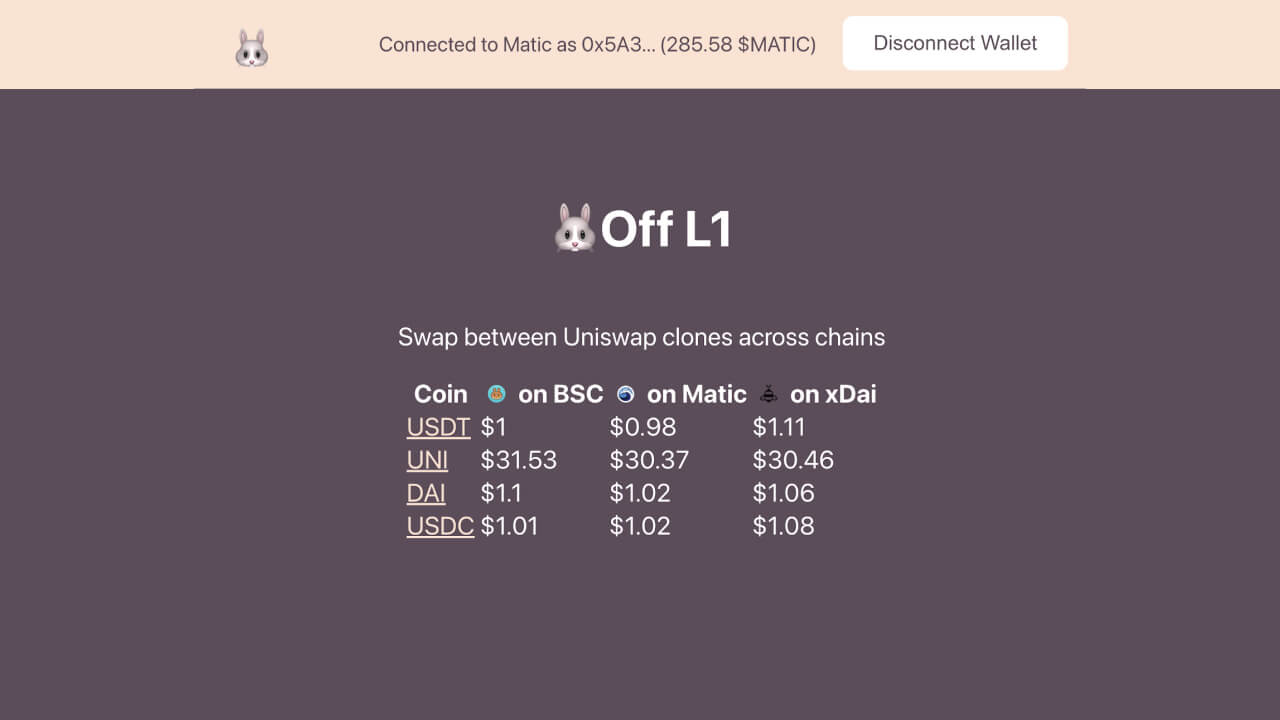

I also recently prototyped Off-L1 which allows you to do arbitrage trading of stablecoins between xDAI-BSC-Matic, all in one click.

Off-L1 - source

Zapper, which tracks all your Defi assets and now NFTs, also announced support of the multi-chains so you can see all your assets holding across different chains in one page.

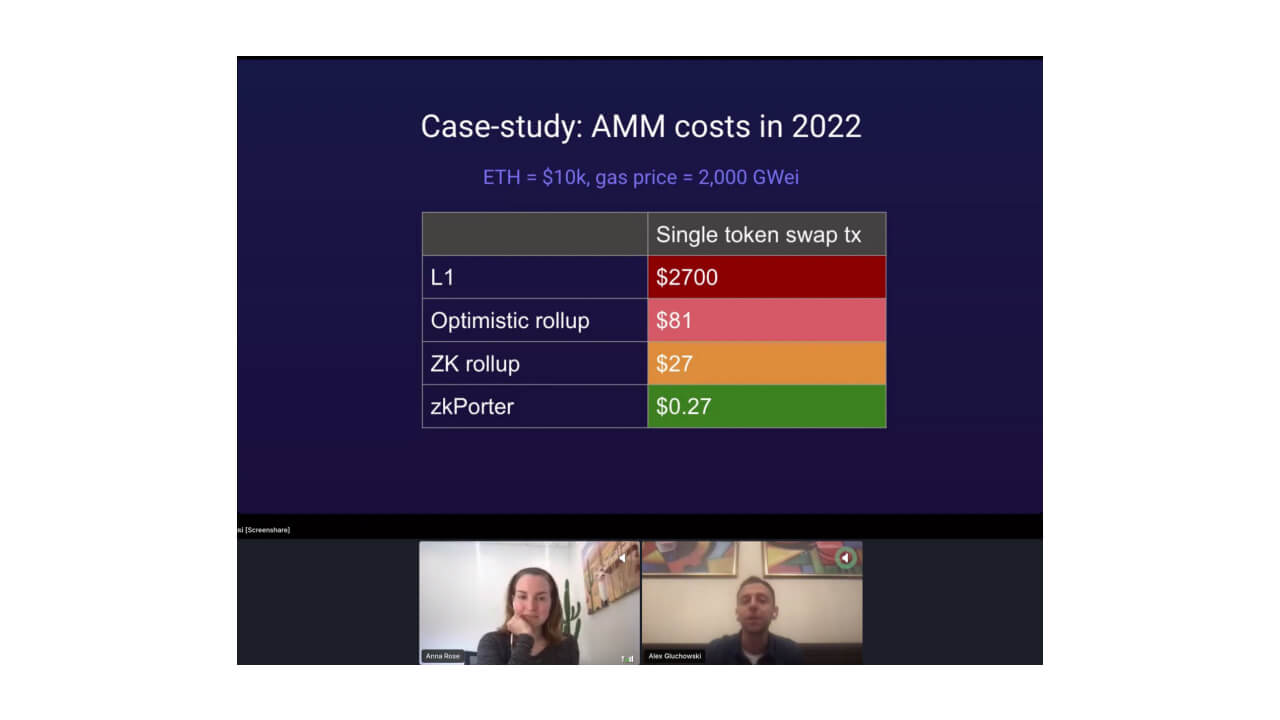

What's interesting is that all these announcements were made in the last few months. The innovation around L2/sidechain is the main challenge on Ethereum this year as L1 is soon becoming a place only for the whales. Unless you want to only build your community members via whales, you need to start planning the escape plan NOW.

From presentation at zkSessions - source

Community Engagement (4/5) - Enjoy more interaction without worrying about gas

Once you obtain these social tokens, what do you use them for? There are many services which offer value to token community members:

- Governance voting with Snapshot (Supports 26 different chains)

- Member only chat rooms or discord channels with Collab.land bot framework (NEAR, BSC, Matic/Polygon, and xDAI)

- Manage group treasury with Gnosis Multisig Wallet (xDAI)

- Organise events with Kickback and give POAP badges to attendees (xDAI)

Low gas cost in L2/sidechains means users don't have to worry about using these or other Dapps. Also, there won't be a situation where you cannot have access to member only chat channels because your token balance is not on chain.

Buy NFTs with your social token (2/5) - OpenSea on Matic is big news

Another use case of social tokens is to use it as a medium of exchange. Some artists accept social tokens to purchase their NFTs.

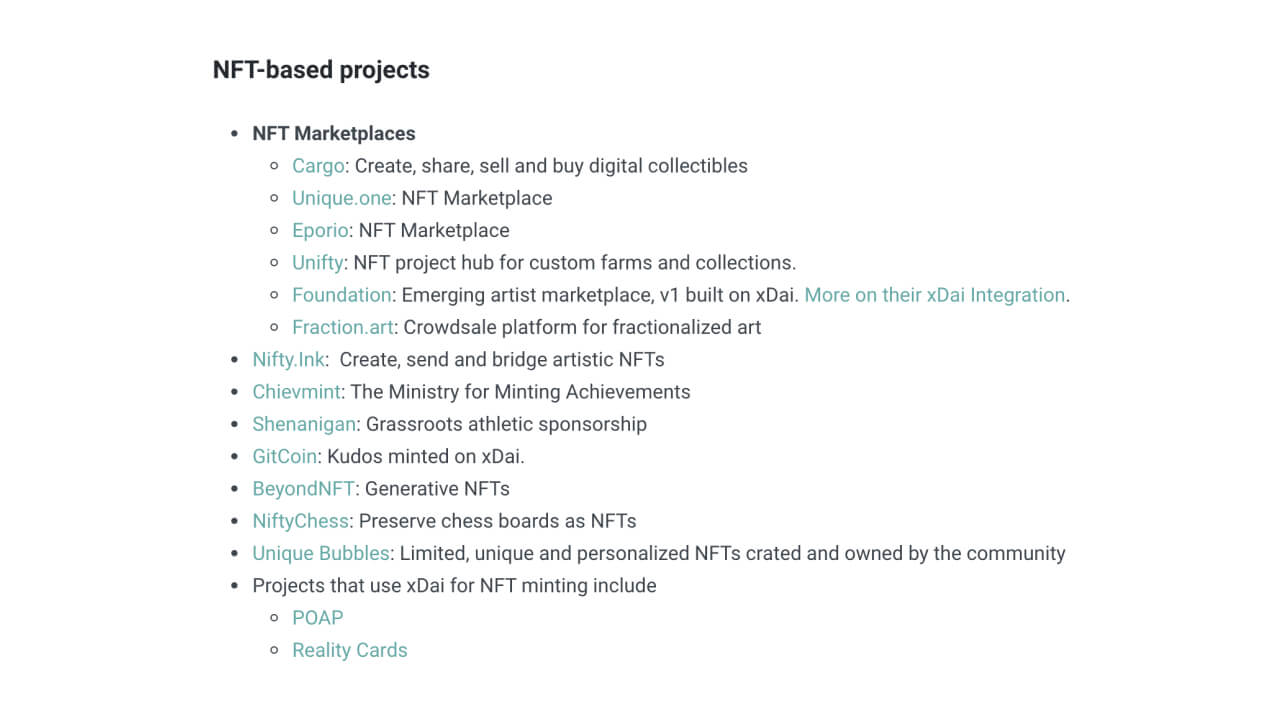

Even though the majority of the NFT marketplace still runs on L1, OpenSea started BETA support on Matic and some known NFT metaverse like CryptoVoxels seem to be planning to support the platform, while many NFT projects picked xDAI and BSC.

List of NFT projects on xDAI from - source

List of NFT projects on BSC - source

Cashing Out (2/5)

One way to measure success of a social token is total market cap. The more your token becomes valuable, the more people start wanting to buy your tokens, pushing up the token price. social tokens are less likely to be listed on centralised exchanges, so the best place to get tokens are Automated Market Maker (aka AMM) such as Uniswap, but users will face high slippage if the overall market is too small.

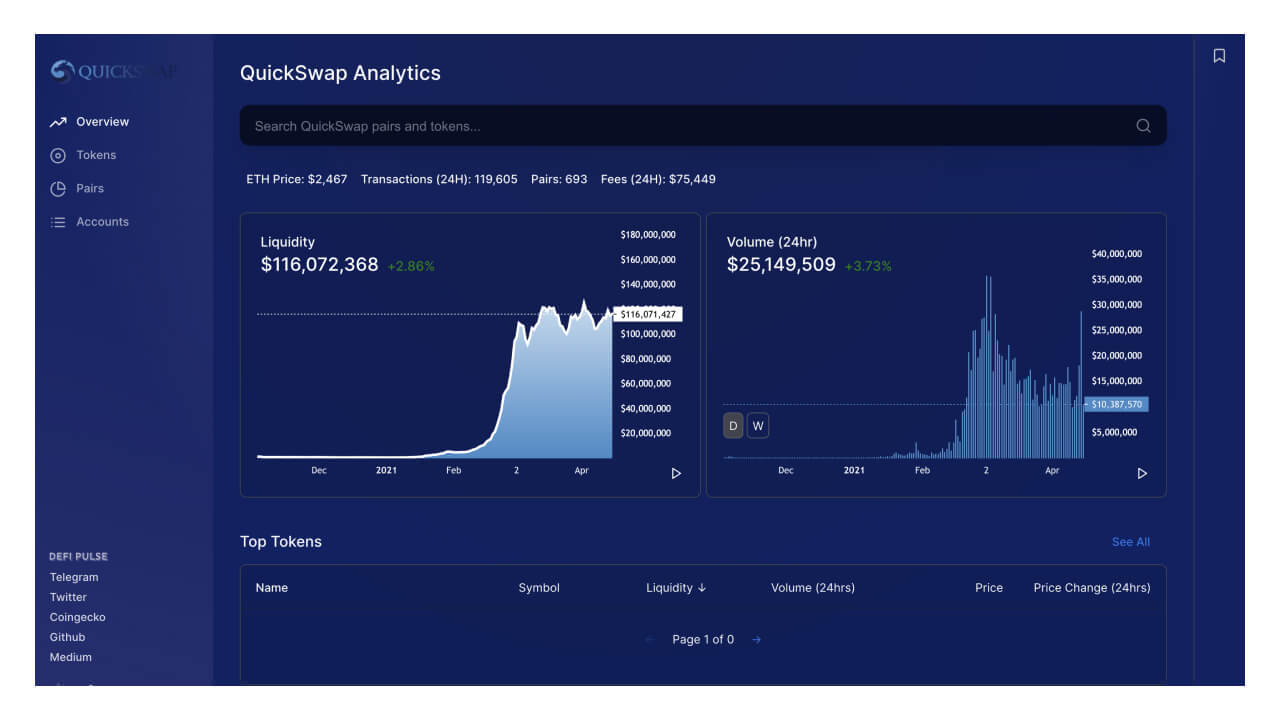

Quickswap Analytics - source

Having said that, the situation around AMM has also changed very drastically in the last 3 months. There are projects that started launching liquidity mining on each L2/sidechains and the liquidity and volume are rising at a significant speed.

As a result, the liquidity of QuickSwap on Matic/Polygon network surpassed over $100M while PancakeSwap on BSC is over $1.6 billion. xDAI volume is a lot smaller than the other two networks but still the volume doubled in the last few months.

SushiSwap announced to go multichain and their liquidity mining wars will probably teach Defi users how to go cross chains.

Summary

Let's recap our evaluations.

- Minting new tokens (2/5)

- Airdrop (5/5)

- On-boarding (2/5)

- Community Engagement (4/5)

- Buy NFTs with your Social Token (2/5)

- Cashing Out (2/5)

The advantage of using L2/sidechains is the cheap gas cost. This will allow you to distribute tokens as widely as possible. Low gas plus more on-chain token data means it's also easier to integrate with valuable Dapps like Collab.Land or Snapshot. The downside is that because L2/sidechains are new with low liquidity, onboarding users to each platform and letting them exchange tokens freely is still a bit of challenge. Having said that, the recent exodus of Defi projects to L2/sidechains is helping users getting used to it really quickly.

Issuing social Tokens on L2/sidechains may still be a bit risky but it is also an opportunity. Because their gas is a lot cheaper, it is a lot easier to experiment with various things. If one way of distributing tokens didn't work well, you could re-issue "upgraded" versions of new tokens without worrying too much about another airdrop cost. You want to issue new tokens every new season? Why not? You will have a whole new token design space once released from the "gas" constraints.